Trade Tariff: look up commodity codes, duty and VAT rates

Search for import and export commodity codes and for tax, duty and licences that apply to your goods.

Get Inquiry

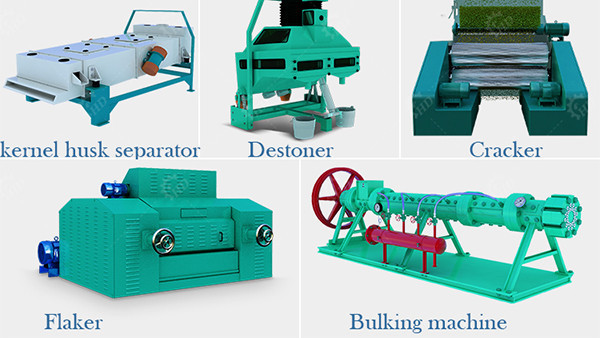

small scale oil pressing machine south africa

Small Scale Oil Extraction Machine, Small Scale Oil. Our Company offers 2,064 small scale oil extraction machine products. About 93% of these are oil pressers, 1% are evaporator, and 1% are other pharmaceutical machinery. A wide variety of small scale oil extraction machine options are available to you, such as paid samples.

Get Inquiry

oil pressing machines south africa

oil press machines for sale in south africa [ 4.6 - 7888 Ratings ] The Gulin product line, consisting of more than 30 machines, sets the standard for our industry. We plan to help you meet your needs with our equipment, with our distribution and product support. Get Price.

Get Inquiry

Tariff Code Lookup - Import Export License

Step 4 ¨C Find your heading and subheading. Each chapter in Schedule 1 Part 1 is divided into tariff headings. Headings are the lines with only 4 digits in the first column called ¡°Heading/Subheading¡±. These lines are easily visible because they are highlighted in grey. Look through your chapter for the most applicable heading to your goods.

Get Inquiry

Philippine Tariff Finder ¨C Bureau of Customs

R.A. 10863 - Customs Modernization and Tariff Act; Import Clearance Overview; Gender Equality and Diversity; Philippine National Trade Repository; Philippine Tariff Finder; Authorized Economic Operator

Get Inquiry

Easy Operation Oil Extraction Machine For Hemp Of South Africa

Cannabis Extraction Equipment For Cannabis Oil Concentrate. Designed by staff engineers with expertise in industrial automation and 17-plus years¡¯ experience building cannabis oil extractors.Apeks Supercritical CO 2 extraction systems efficiently extract pure, high-quality essential oils.While any botanical material can be extracted, the majority of our customers use Apeks equipment to

Get Inquiry

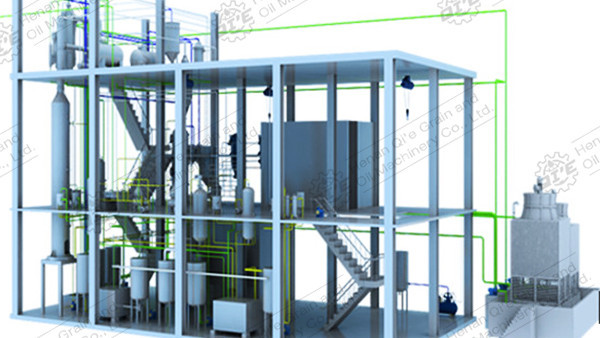

Sunflower Oil Processing Oil Press Machinery In South Africa

Commercial Screw Cold Sunflower Oil Making Press Machine. 1. High oil quality: meet people health standards.2. High oil yield and purer oil:The equipped vacuum filter is used to remove impurity to ensure the pure oil quality and meet the standards of health quarantine.3.Wide application of different oil seeds:The machine can press more than 20 kinds of oilseeds, such as soybean, peanut, sesame

Get Inquiry

South Africa - Import Tariffs - export.gov

The dutiable value of goods imported into South Africa is calculated on the f.o.b. (free on board) price in the country of export, in accordance with the WTO (ex-GATT) Customs Valuation Code. The value for customs duty purposes is the transaction value, or the price paid or payable. In cases where the transaction value cannot be determined, the

Get Inquiry

Current working tariff - Australian Border Force Website

This is the online version of the current Combined Australian Customs Tariff Nomenclature and Statistical Classification or 'Working Tariff'. It contains: the tariff changes from the World Customs Organization sixth review of the International Convention on the Harmonized Commodity Description and Coding System, commonly referred to as the Harmonized System

Get Inquiry

Tariff - South African Revenue Service

The Tariff Book indicates the normal customs duties (Schedule No 1, Part 1), excise duties (Schedule No 1, Part 2A), ad valorem duties (Schedule No 1, Part 2B), anti-dumping duties (Schedule No 2, Part 1) and countervailing duties (Schedule No 2, Part 2) that would be payable on importing goods into South Africa. Tariff classification of goods also determines the necessity for import control

Get Inquiry

Tariff Code Lookup - Import Export License

Step 4 ¨C Find your heading and subheading. Each chapter in Schedule 1 Part 1 is divided into tariff headings. Headings are the lines with only 4 digits in the first column called ¡°Heading/Subheading¡±. These lines are easily visible because they are highlighted in grey. Look through your chapter for the most applicable heading to your goods.

Get Inquiry

Where do I find the latest import and export tariffs and information

An import tariff is a tax imposed on imported goods and services. Different rates of duty are applicable to different goods or commodities. Once the goods to be imported has been identified, particulars can be provided to South African Revenue Service (Customs) at tel: +27 (0)12 422 4000, who will advise on the relevant tariff heading and applicable duty (including VAT payable).

Get Inquiry

Tariff code directory - Trade Logistics

The first 2 digits of a tariff code refer to the chapter in the tariff book it falls under. The first 4 digits are called the tariff heading and represent a broad category of products. A full South African tariff code is made of 8 digits and a 9th check digit. This code represents a specific product or commodity.

Get Inquiry

Parts and accessories of the machines of heading 84.70:

Subject to the operation of Note 3 to Section XVI and subject to Note 9 to this Chapter, a machine or appliance which answers to a description in one or more of the headings 84.01 to 84.24, or heading 84.86 and at the same time to a description in one or other of the headings 84.25 to 84.80 is to be classified under the appropriate heading of

Get Inquiry

SCHEDULE 1 / PART 1 CUSTOMS DUTY

Heading / CD Article Description Statistical Rate of Duty Subheading Unit General EU / UK EFTA SADC MERCOSUR AfCFTA 0105.99 9 - - Other u free free free free free free 01.06 Other live animals: 0106.1 - Mammals: 0106.11 5 - - Primates u free free free free free free 0106.12 1 - - Whales, dolphins and porpoises (mammals of the order Cetacea);

Get Inquiry

South Africa - Import Tariffs - International Trade Administration

Complexity South Africa reformed and simplified its tariff structure in 1994. Tariff rates have been reduced from a simple average of more than 20 percent to an average of 7.1 percent in 2020. Notwithstanding these reforms, importers have complained that the tariff schedule remains unduly complex, with nearly forty different rates.

Get Inquiry

Import duty directory and calculation - Trade Logistics

The tariff book. The South African tariff book is broken into various schedules listing different types of taxes and rebates. The sections listing import duties and levies are: Schedule 1 Part 1 ¨C Ordinary Customs Duty listings. This is the only schedule which lists all the South African tariff codes according to Chapter.

Get Inquiry

HS 2012 - South African Revenue Service

These Notices contain inter alia consequential amendments as a result of the HS 2012 amendment implemented in Part 1 of Schedule No. 1 and were published in Gazette 34772 on 2 December 2011 as follows: Notice R.972 (Schedule No. 2) ¨C effective from 1 January 2012. Notice R.973 (Schedule No. 3) ¨C effective from 1 January 2012.

Get Inquiry![customs - tariff book [site:tariff-book-date] - freight news](/pic/machine-for-press-oil-68.jpg)

Customs - Tariff Book [site:tariff-book-date] - Freight News

SA Customs Tariff (Schedule 1 Part 1) Print. Live Animals; Animal Products [permalink] Vegetable Products [permalink] Animal or Vegetable Fats and Oils and their Cleavage Products; Prepared Edible Fats; Animal or Vegetable Waxes [permalink] Prepared Foodstuffs; Beverages, Spirits and Vinegar; Tobacco and Manufactured Tobacco Substitutes

Get Inquiry